Video Banking

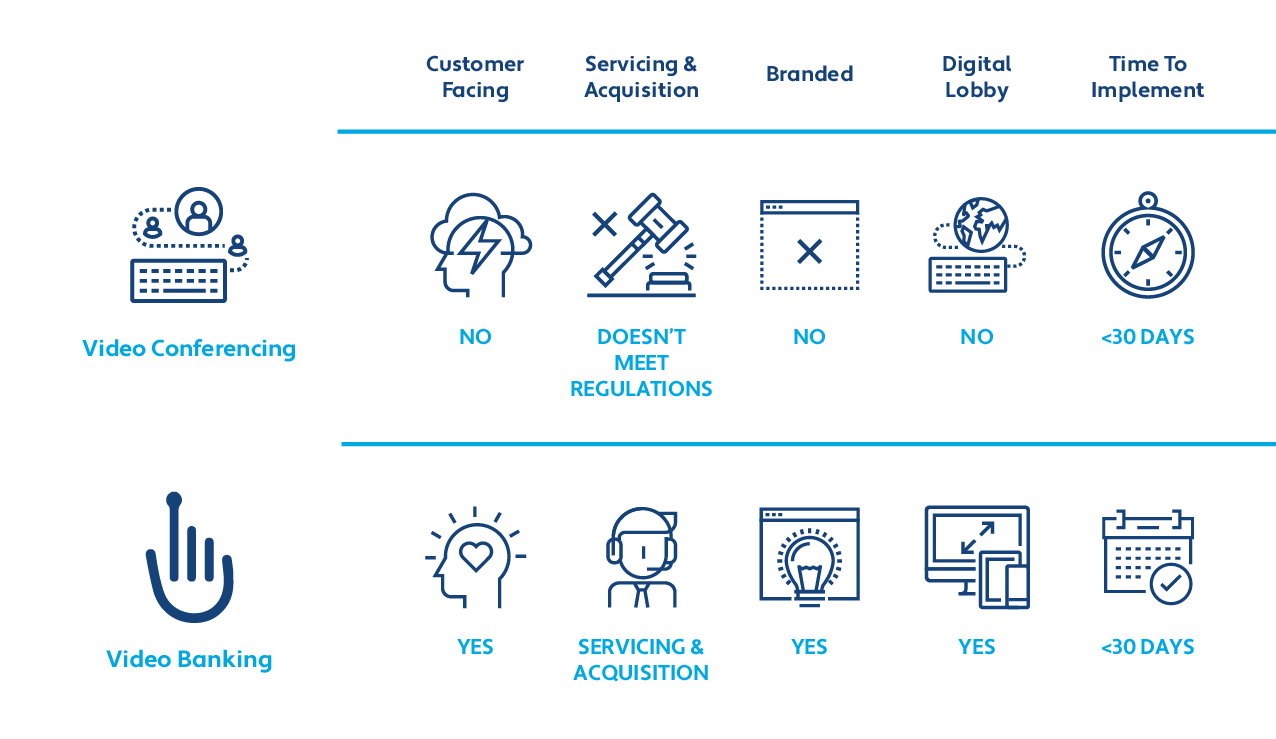

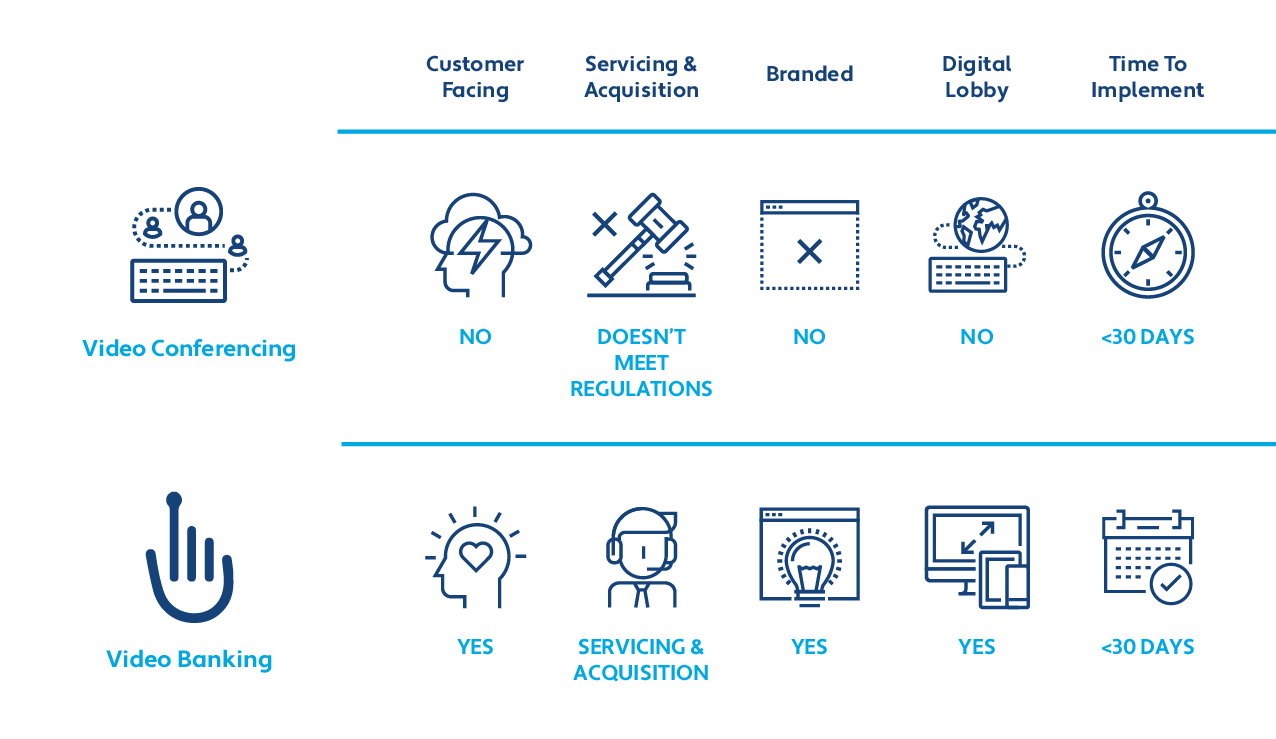

Why Video Conferencing Doesn’t Work For Video Banking: Video Conferencing VS. Video Banking Breakdown

Video Conferencing is meant for an Internal communication tool; not for customer-facing interactions. You need much more to have a fully streamlined video product when it comes to external customer-facing video chats. A tool that not only has the simplicity for all customer demographics to connect through their browser, in two clicks or less but the processes and workflows to accommodate the entire video banking journey.

There are very distinct differences between video conferencing and video banking, and in order to deliver the experience your consumers expect and maintain your service standards, you definitely need to offer video banking.

What are the critical components when comparing Video Conferencing VS. Video Banking?

Customer-Facing Tech

Video Conferencing isn’t made for B2C, customer-facing transactions. While Video Conferencing enables communication between businesses — it does not address the consumer side of collaboration. Additionally, most video conferencing platforms require both parties to set a date and time to communicate, which creates service friction.

Servicing & Acquisition Abilities

Popular video conferencing solutions require multiple clicks, software downloads, and a disintegrated approach. Users start within a bank’s site or app but then are forced to move to that software’s native app. The more hurdles a customer has to jump, the more friction is created. Once a customer is using a 3rd party’s video conferencing product, your financial institution loses all control over your customers’ experience — making both servicing current customers and engaging new ones a hassle. By embedding video banking directly into your website, your customers can enter a call with a bank representative with just one click – from anywhere, at any time.

You’re not Zoom — or Google Meet, or Skype, or anyone else — so why would you want your customers to spend time away from your website and branding? By pushing your people to other party’s software, you lose valuable brand recognition time and analytics.

Getting valuable member or customer data from banking transactions or branch experiences usually takes weeks to obtain. What if you could get data instantly within seconds to be able to glean insights into your operations, marketing, and customer experience. This valuable data gives you the ability to make real-time changes to marketing efforts, staffing, and management.

To compete with direct banks, most financial institutions initially place a higher emphasis on acquisition components. They look to reinvent how they acquire customers with a high-touch personalized digital experience that gives them a competitive advantage. For years, financial institutions have been racing to implement digital technologies, which has only been accelerated by innovation from new Fintech companies, and the pandemic. The innovative banks that had a video banking solution implemented prior to the pandemic weren’t shut down and with one click they were able to mobilize their digital lobby and employees in seconds.

A Digital Lobby allows prospects and customers to walk into your bank or credit union with their mouse vs. their feet. Instead of an employee walking over to greet them, they come into a virtual queue and any employee regardless of location can talk to them through video chat. No need to have customers wait in the lobby for twenty minutes while your bankers are working with another customer. Instantly see which skilled employees are available now, and add them to the video call.

Time-To-Implement

Your white-labeled Video Banking software can be up and running within 24 hours. Really. It takes 5 minutes to add the digital lobby directly to your website — and just about 30 minutes to train admin and on-site staff. With 3 ways for your customers to connect with you; you can build a bridge between branches to decrease operating expenses, optimize your workforce, and create bigger radius marketing opportunities — all seamlessly.

Video customer service allows you to extend your bank lobby digitally into homes, connecting the RIGHT bank employee regardless of location, at the right time. With smaller branch footprints, for those that come into a physical branch, connect them instantly through video stations to the right resource, at the right time.

Digital video banking is the tool you need in your arsenal to increase conversion rates, deepen relationships, and give you competitive advantages. Interested in learning more? The Executive Guide For Success In Video Banking white paper goes over why Video Conferencing doesn’t work for Video Banking, how Video Banking and new customer acquisition work together, how Video Banking works when somebody comes into the branch, and much more.