Video mortgage advisors are here!

This Coffee with Carrie session talks about “what are video mortgage advisors” and goes over some published ROI numbers you don’t want to miss. The mortgage industry is a competitive area and with more and more online lenders and non-depository lenders taking serious market share you need a competitive advantage. The average age of homebuyers in 2017 was 44 and 50% of new home purchasers are 36 and younger, the expectations have changed. Any banking and/or mortgage executive should have video chat solutions for mortgage on their roadmap for 2018. Listen why!

Video mortgage advisors make a great first impression for the 54% of consumers that are shopping for a lender online.

Create a HUGE competitive advantage and have your loan officers video for a pre-qual to increase your close rate by two-thirds.

Did you know that 82% of home buyers in 2017, got a pre-approval prior to looking for a home? With the average time being over four months in actually finding the right home, there leaves a lot of time for the requirement hand-holding necessary to keep the prospective customer.

The home buying process is complex, with 47% of the under 36 demographic being a first time home buyer. Advice is required throughout the loan process, to help with uncertainty and doubt. These prospective loan customers are not all about the rate. They rank getting the right product and getting advice at almost the same percentage as rate.

Most of all, this demographic is all about face to face relationships and companies being authentic. You can get them interested with cutting-edge technology. However, you won’t close them or keep them for referral business without a strong human connection strategy via video mortgage advisor solutions.

Video mortgage advisors and video chat solutions for the mortgage industry can:

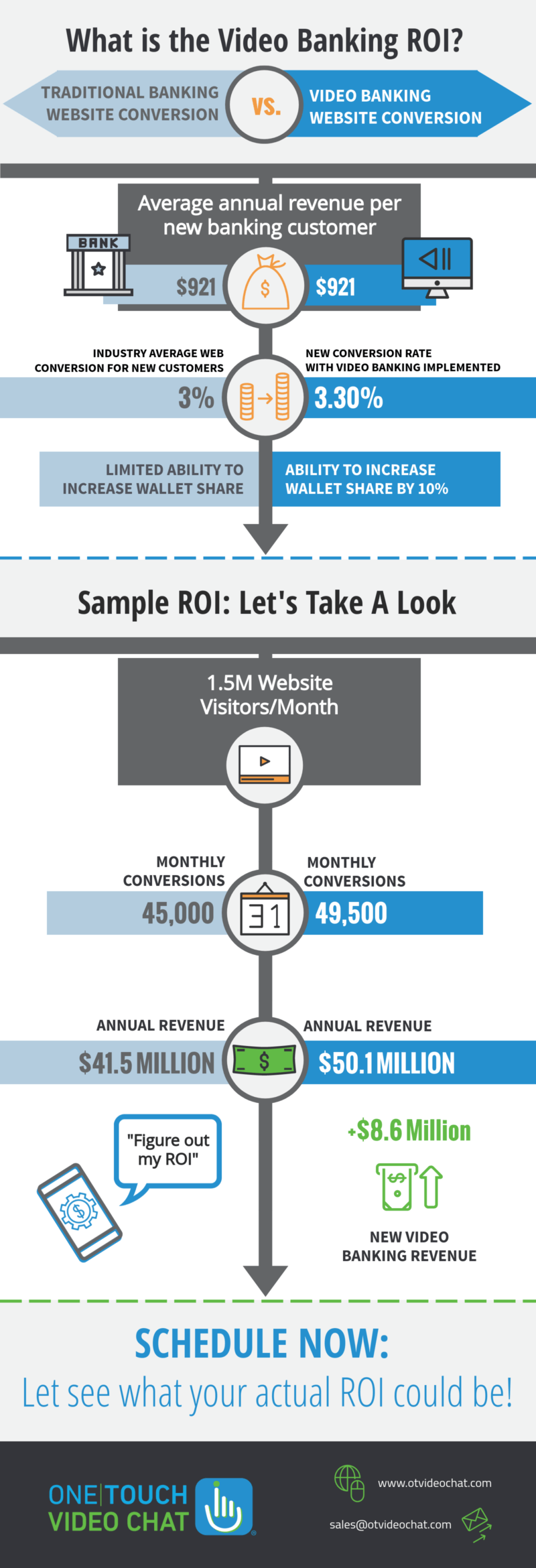

- Give you quick ROI

- Reduce costs by two-thirds

- Increase your NPS scores by double digits

To learn more about video mortgage advisors and video chat solutions for mortgage.